DonateEquity™ MAKES EQUITY DONATION EASY

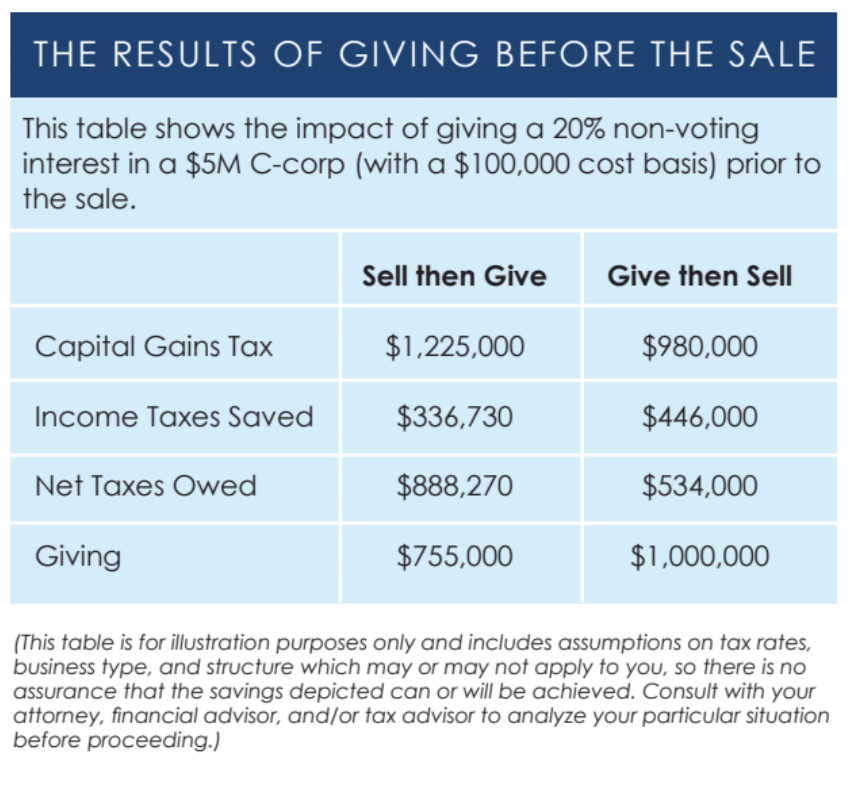

DonateEquity works with entrepreneurs and investors to donate a non-voting interest in your business before the sale, receive a substantial tax deduction, reduce or eliminate capital gains taxes on the gifted interest, and convert those tax dollars into more giving to your favorite charities.

WHAT DOES THIS MEAN TO ENTREPRENEURS?

Entrepreneurs are creating value in the world and many are choosing to reinvest into their community. By donating prior to the sale of your business, you can reduce your tax liability and donate or invest that money where you want it to matter most.

- Write off the pro-rata value of your donation

- Choose to donate to a charity or invest in startups

WHAT DOES THIS MEAN TO CHARITABLE ORGANIZATIONS?

We bring donors to your doorstep. We’re bringing the convenience of qualified, high dealflow right to your door. By working with us, you end up with more dollars flowing to your cause than you ever imagined possible. Donors are more incentivized to give in new ways and in higher amounts.

- More donations

- New ways for donors to give

- Short-term or long-term

WHAT DOES THIS MEAN TO INVESTORS?

Like entrepreneurs, investors are able to donate equity before the sale of a business. By doing so, you are able to donate the same amount of money you planned on giving but retain more for yourself. Some companies have reaped higher returns while others struggle. Some are hard to sell. You can potentially entrust the struggling companies to non-profits that need technical assets and write off the full value of these companies rather than writing off a loss that could be substantial. Offsetting your losses means more net gains.

- Write of the pro-rata value of your donation

- Offset your portfolio losses to yield higher ROI